Child Tax Credit 2024 Income Limits Married – A guide to the Child Tax Credit in 2024. The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows . If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can .

Child Tax Credit 2024 Income Limits Married

Source : www.cpapracticeadvisor.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

IRS Announces 2024 Income Tax Brackets. Where Do You Fall

Source : drydenwire.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

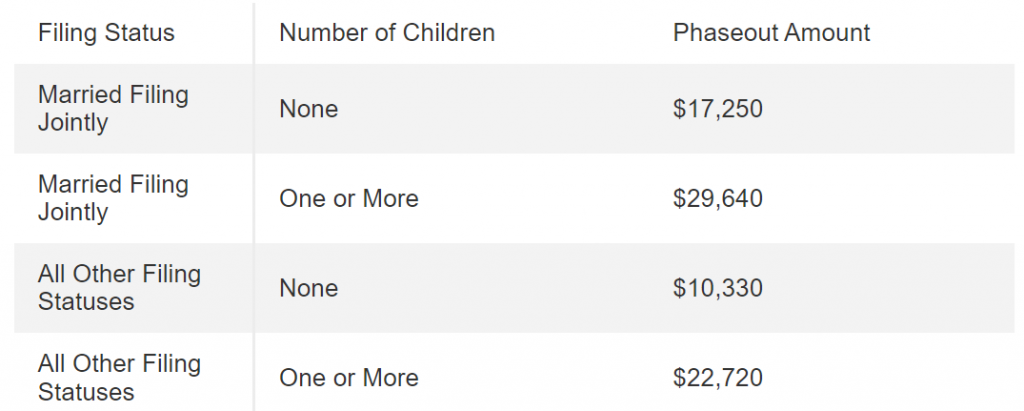

Child Tax Credit 2024 Income Limits Married Projected 2024 Income Tax Brackets CPA Practice Advisor: (Note: Income limits apply.) And unless Congress makes legislative changes to the credit, the child tax credit EITC credit in 2024. (All other filing statuses also apply to married taxpayers . While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. .