Child Tax Credit 2024 Phase Out California – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . If you live in one of these states, you could be getting another child tax credit payment in addition to the federal amount. .

Child Tax Credit 2024 Phase Out California

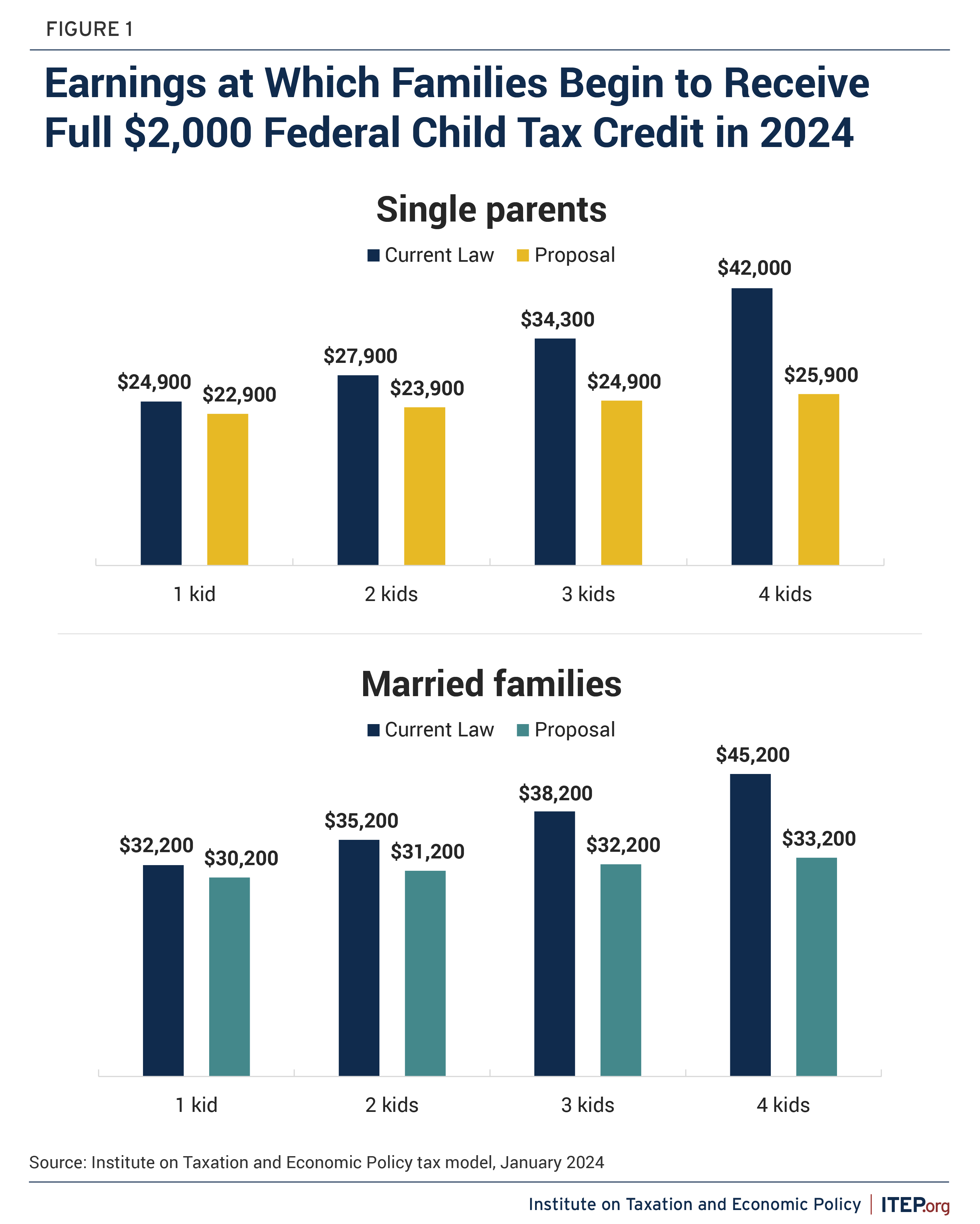

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Will You Get a State Child Tax Credit Payment in 2024? Find Out

Source : www.cnet.com

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024 Phase Out California States are Boosting Economic Security with Child Tax Credits in : In addition to the federal tax credit, here is a list of those available at the state level as well as information on who qualifies. . Claiming the child tax credit for a reduced credit. Below are the completed income phase-out amounts (not eligible to claim the credit) for claiming the EITC credit in 2024. .